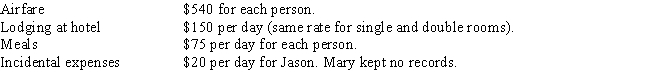

Jason travels to Miami to meet with a client.While in Miami,he spends 2 days meeting with his client and 3 days sightseeing.Mary,his wife,goes with him and spends all 5 days sightseeing and shopping.The cost of the trip is as follows:

If Jason is self-employed,what is the amount of the deduction he may claim for the trip?

Definitions:

Q5: Rand Company purchases and places into service

Q8: Capital asset<br>A)Limited to $3,000 annually for individuals.<br>B)When

Q23: The Wilson Corporation incurs the following expenses.Explain

Q52: If a taxpayer has the following for

Q57: Maria is on a "full ride" tennis

Q75: Business gift<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q96: Mitaya purchased 500 shares of Sundown Inc.

Q113: Armando has AGI of $80,000 and makes

Q122: Brandon is retired and lives with his

Q135: Flexible benefits plan<br>A)An employee may exclude up