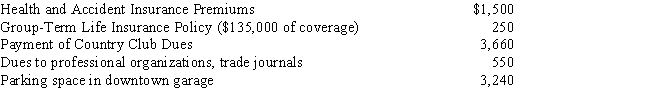

Summary Problem: Ralph,age 44,is an account executive for Cobb Advertising,Inc.Ralph's annual salary is $90,000.Other benefits paid by Cobb Advertising were:

In addition to the benefits above,Cobb Advertising has a qualified pension plan into which employees can contribute (and Cobb matches)up to 5% of their annual salary.Ralph contributes the maximum allowable to the plan.

Ralph has never been able to itemize his allowable personal deductions (i.e. ,he always uses the standard deduction).In 2017,Ralph receives a refund of $300 of his 2016 State income taxes and a 2016 Federal tax refund of $400.

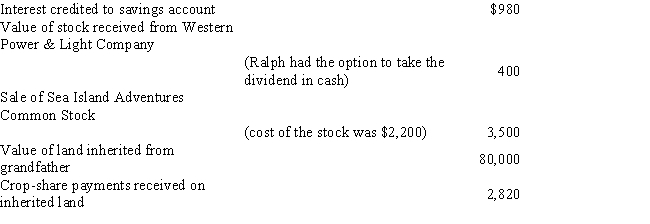

Other sources of income:

Required: Compute Ralph's 2016 gross income.

Definitions:

Interpret Sentences

The cognitive process of understanding the meaning of phrases and clauses in language.

Effortful

Pertaining to an action requiring considerable mental or physical effort.

Online

Connected to or available through the internet or a computer network.

Garden Path Sentences

Sentences that lead readers to misinterpret the first part, requiring a reevaluation for understanding.

Q25: The excess of an asset's tax basis

Q38: Richard,a cash basis taxpayer,is an 80% owner

Q51: Frank is a self-employed architect who maintains

Q53: Anna receives a salary of $42,000 during

Q55: Donna is an audit supervisor with the

Q66: Illegal gambling operation expenses<br>A)Capitalized and amortized over

Q83: Which of the following items is a

Q92: Summary Problem: Ralph,age 44,is an account executive

Q109: Three years ago Edna loaned Carol $80,000

Q141: Dick lives rent-free in an apartment (value