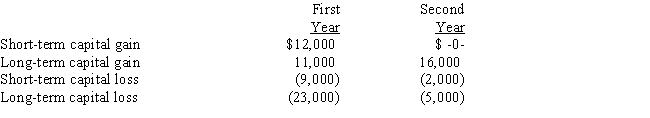

Given below are Mario's capital gains and losses for two consecutive years.What is the effect of the capital gains and losses on Mario's taxable income for each year?

First Second

Year Year

Definitions:

Prepayments

Payments made in advance for goods or services, which are recorded as assets on the balance sheet until the corresponding goods or services are received.

Unearned Revenue

Money received by an entity for a service or product yet to be delivered or performed.

Adjusting Entry

A journal entry made in accounting records to update the balances of accounts at the end of an accounting period before financial statements are prepared.

Revenue and Expense Account

Accounts in the general ledger that track the income earned and expenses incurred by a business during a given period, critical for determining net income.

Q4: Information security professional report spending a lot

Q15: Allowing individuals to deduct a standard deduction

Q34: Which of the following items is not

Q41: Tom and RoseMary own a cabin near

Q78: Bonita,age 23,is an employee of Watson Hardware

Q78: Sally is a single individual.In 2016,she receives

Q106: Cornell is a building contractor who builds

Q120: For each tax treatment described below,indicate which

Q128: Which of the following payments meets the

Q138: A CPA may prepare tax returns using