Use the information for the question(s) below.

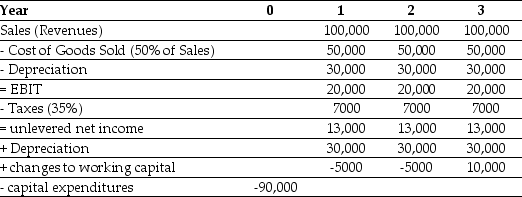

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

Definitions:

Saddles Imported

The act of bringing in saddles from foreign countries for sale within the domestic market.

Quantity

The amount or number of a material or immaterial good or service.

Tariff

A tax imposed by a government on imported goods, often used to protect domestic industries and adjust trade balances.

Carnations

A species of flowering plant in the Dianthus genus, often used in bouquets and floral arrangements.

Q1: The continuation value for the trucking division

Q5: Money that has been or will be

Q9: The NPV of manufacturing the armatures in

Q17: U.S.public companies are required to file their

Q18: The price per $100 face value of

Q36: Epiphany would like to know how sensitive

Q41: A firm's net investment is:<br>A)its capital expenditures

Q50: A project you are considering is expected

Q85: A corporate bond which receives a BBB

Q173: How is the balance sheet linked to