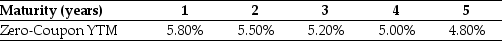

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The price today of a 3-year default-free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

Definitions:

Illness

A condition of being unwell, either physically or mentally.

Judgment Debt

The amount of money that a court has ordered one party to pay another party as a result of legal action.

Exempt Property

Assets that are protected by law from being seized by creditors or during bankruptcy proceedings.

Collateral

Assets pledged by a borrower to secure a loan or credit, which can be seized by the lender if the borrower fails to make payments.

Q3: Which of the following statements is FALSE?<br>A)Because

Q9: You are saving for retirement.To live comfortably,you

Q12: The credit spread on BBB-rated corporate bonds

Q46: Due to a pre-existing contract,Recycle America Inc.has

Q58: The Dodd-Frank Wall Street Reform and Consumer

Q73: The enterprise value of CCM corporation is

Q85: When we express the value of a

Q85: Vick Corporation has been in the

Q102: Luther Corporation's stock price is $39 per

Q194: Read the information for Canyon Corporation and