Use the following information to answer the question(s) below.

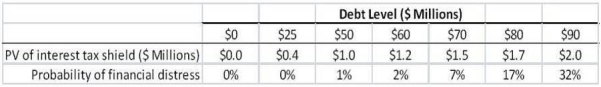

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $25 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

High-end Watches

Luxury watches that embody superior quality, craftsmanship, and design, often representing status and wealth.

Competitive Advantage

A unique attribute or competency a company possesses that enables it to outperform its competitors, providing it with a market advantage.

Brand Loyalty

The tendency of consumers to continuously purchase one brand's products over competing ones due to their trust and satisfaction with the brand.

Rewards Program

A marketing strategy designed to encourage customer loyalty by offering incentives, such as points, gifts, or discounts, for frequent or sizable purchases.

Q38: If the risk-free rate of interest is

Q39: The value of the gas and convenience

Q48: If Moon Corporation's gross margin declined,which of

Q50: Which of the following statements is FALSE?<br>A)Whether

Q50: The unlevered cost of capital for Antelope

Q59: Luther's earnings before interest,taxes,depreciation,and amortization (EBITDA)for the

Q60: Assume that investors hold Google stock in

Q64: Which of the following statements regarding portfolio

Q74: If Moon Corporation has an increase in

Q100: Assume that in the event of default,20%