Use the following information to answer the question(s) below.

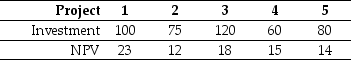

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-If Nielson Motors invests in only those projects which are beneficial to the stockholders,then the total debt overhang associated with accepting these project(s) is closest to:

Definitions:

Q6: The cost of _ is highest for

Q8: Taggart Transcontinental currently has no debt and

Q8: Another oil refiner is offering to trade

Q14: At the conclusion of this transaction,the number

Q28: Alpha Beta Corporation maintains a constant debt-equity

Q39: Luther's current ratio for 2009 is closest

Q53: The statement of financial performance is also

Q60: Consider an equally weighted portfolio that contains

Q68: Which of the following statements is FALSE?<br>A)One

Q93: Suppose over the next year Ball has