Use the following information to answer the question(s) below.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The beta of the precious metals fund with the Luther Fund  is closest to:

is closest to:

Definitions:

Bone Marrow

A soft tissue inside bones where blood cells are produced, including red blood cells, white blood cells, and platelets.

Stem Cells

Undifferentiated cells capable of giving rise to indefinitely more cells of the same type, and from which certain other kinds of cells arise by differentiation.

Negative-Feedback

A process in which increases in output lead to future decreases in the same output, stabilizing systems against fluctuations.

Aldosterone

A substance generated by the adrenal glands that plays a role in regulating blood pressure through managing the balance of sodium and water in the body.

Q12: How much would you receive if you

Q35: Assume that you purchased J.P.Morgan Chase stock

Q38: The market capitalization of d'Anconia Copper after

Q45: Opportunity cost is the equivalent of:<br>A)explicit cost.<br>B)implicit

Q52: The Market's average historical return is closest

Q65: The value of Shepard Industries with leverage

Q73: Which of the following statements is FALSE?<br>A)We

Q74: Luther's after-tax debt cost of capital is

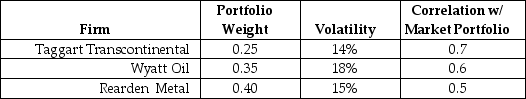

Q79: The expected return on the portfolio of

Q81: Which of the following statements is FALSE?<br>A)Firm-specific