Use the following information to answer the question(s) below.  The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The Sharpe Ratio for the market portfolio is closest to:

Definitions:

Determinants

Factors or variables that significantly influence the outcome or dynamics of a particular system, market, or economic model.

Intangible Attributes

Characteristics of a product or service that cannot be physically touched or measured but influence consumer perception and value.

Tangible Elements

Physical or concrete components that can be seen, touched, and measured, as opposed to abstract or theoretical elements.

Inspection Point

A specific location or stage in the production or supply process where quality or compliance checks are performed.

Q11: Suppose you are a shareholder in Galt

Q12: Which of the following statements is FALSE?<br>A)The

Q14: The present value of LCMS' interest tax

Q17: Value judgments:<br>A)always produce predictable results.<br>B)are subjective opinions

Q19: Wyatt Oil has 25 million shares outstanding

Q25: Consider a graph with hamburger on the

Q37: Nonsatiation implies that marginal utility is:<br>A)always greater

Q53: An individual's desire for intense risk-taking experiences

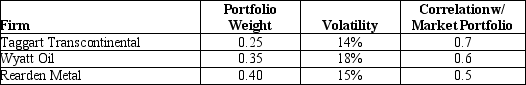

Q54: You want to maximize your expected return

Q66: The expected overall payoff to Bank B