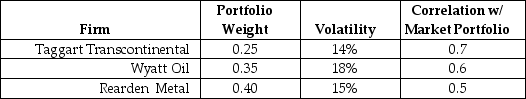

Use the following information to answer the question(s) below.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The beta of the precious metals fund with the Luther Fund  is closest to:

is closest to:

Definitions:

Net Operating Income

A company's total pre-tax profit, derived from its normal business operations, excluding non-operating income and expenses.

Special Order

Special Order refers to a one-time or unique request by a customer for a product or service that may differ from the standard offerings of a company.

Net Operating Income

A measure of a company's profitability from its core business operations, excluding expenses and revenues from investments and financing.

Variable Costs

Costs that vary directly with the level of production or output, such as materials and labor.

Q5: What is the Beta for a type

Q13: Which of the following statements is FALSE?<br>A)The

Q16: Assume that MM's perfect capital market conditions

Q16: Which of the following investments offered the

Q26: Which of the following statements is most

Q36: Which of the following statements is FALSE?<br>A)If

Q37: The income effect of a price change:<br>A)is

Q40: The cross price elasticity of demand for

Q73: Which of the following statements is FALSE?<br>A)We

Q89: Which of the following statements is FALSE?<br>A)A