Use the following information to answer the question(s) below.

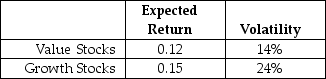

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following statements is FALSE?

Definitions:

Price

The price associated with purchasing a good, service, or asset.

Negligible Fraction

A very small part or amount that is considered insignificant in size or importance.

Purely Competitive Market

A market structure featuring many sellers offering identical products, leading to competition based on price rather than product differentiation.

Demand Curve

A chart that displays the connection between a product's price and the amount consumers want to buy.

Q5: Suppose there are two goods,X and Y,with

Q5: What is the Beta for a type

Q26: The market capitalization of d'Anconia Copper before

Q37: What is the Beta for a type

Q48: If Flagstaff maintains a debt to equity

Q58: Which of the following can be categorized

Q64: Which of the following statements regarding portfolio

Q87: The present value of Wyatt's annual interest

Q90: For the utility function U =3x5y,the slope

Q95: Assume that you purchased General Electric Company