Use the following information and the percent-of-sales method to answer the following question(s) .

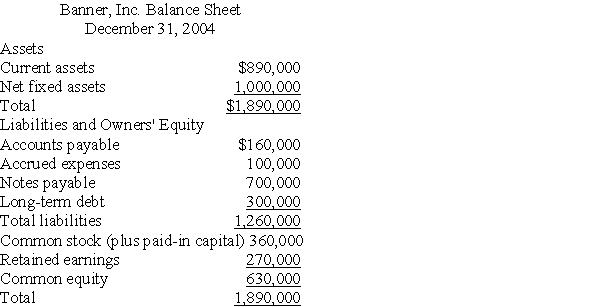

Below is the 2004 year-end balance sheet for Banner,Inc.Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005.In addition,we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales.(For consistency with the Answer selections provided,round your forecast percentages to two decimals. )

-Banner's projected current assets for 2005 are:

Definitions:

Initial Direct Costs

The expenses directly associated with acquiring or originating a new loan or lease, which may include legal fees, processing fees, and commission payments.

Lease Capitalization

The process of recognizing and recording a lease as an asset and a liability on the balance sheet, reflecting its long-term nature.

GAAP

Generally Accepted Accounting Principles; a collection of commonly followed accounting rules and standards for financial reporting.

IFRS

International Financial Reporting Standards, a set of accounting standards designed to ensure transparency, accountability, and efficiency in financial statements globally.

Q1: Which of the following types of insurance

Q14: The capital structure that minimizes the weighted

Q19: Pledging accounts receivable as a source of

Q49: Chelsea Corporation's cost of equity is 16%

Q53: All of the following are found in

Q57: For accounting purposes,a stock split has been

Q59: Which of the following will decrease discretionary

Q63: Stock splits:<br>A)increase the number of shares outstanding.<br>B)decrease

Q86: In theory using the same discount rate

Q121: A spot transaction occurs when one currency