Use the following information and the percent-of-sales method to answer the following question(s) .

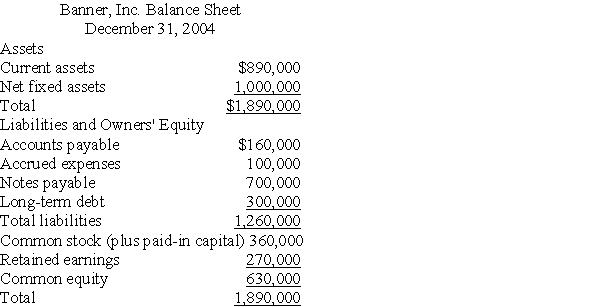

Below is the 2004 year-end balance sheet for Banner,Inc.Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005.In addition,we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales.(For consistency with the Answer selections provided,round your forecast percentages to two decimals. )

-Banner's projected retained earnings for 2005 are:

Definitions:

Ending Inventory

The total value of all inventory a company has in stock at the end of an accounting period, which is used to calculate the cost of goods sold.

Operating Expenses

The costs associated with running the day-to-day operations of a business, excluding the cost of goods sold.

Gross Profit

The difference between revenue and the cost of goods sold, indicating how efficiently a company produces goods or services.

Cost of Goods Sold

Represents the direct costs attributable to the production of the goods sold by a company, including the cost of the materials and labor directly used to create the product.

Q16: Ahmad bought call options on Home Depot

Q16: Which of the following conclusions about dividend

Q22: Bank Two extends a $3 million line

Q35: According to the Modigliani & Miller dividend

Q44: A firm is analyzing two different capital

Q58: Which of the following types of risk

Q70: When forecasting statements,assets always increase proportionately to

Q83: Which of the following is consistent with

Q92: Business risk reflects the added variability in

Q117: The efficiency of foreign currency markets is