Use the following information and the percent-of-sales method to answer the following question(s) .

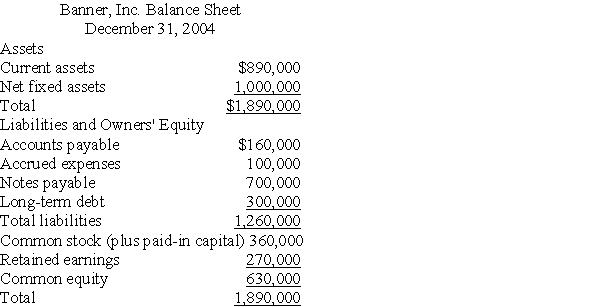

Below is the 2004 year-end balance sheet for Banner,Inc.Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005.In addition,we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales.(For consistency with the Answer selections provided,round your forecast percentages to two decimals. )

-Banner's projected current assets for 2005 are:

Definitions:

Previews and Reviews

A method used in presentations and writings to give a brief introduction or summary before the main content and a recap or evaluation afterwards.

Impersonal Journalism Style

A reporting approach that emphasizes objectivity, factual reporting, and a detached tone, avoiding personal bias or opinion.

Formal Business Report

A structured document that presents information and analysis to assist in business decision-making, often following a standardized format.

Second-Person Pronouns

Pronouns that refer directly to the reader or listener, typically "you," "your," and "yours," used to address the audience directly.

Q12: Moore Financing Corporation has preferred stock in

Q12: Apple Two Enterprises expects to generate sales

Q21: The before-tax cost of this debt issue

Q61: Assume that the current price of FGX

Q71: Which of the following is included in

Q75: Abbot Corporation has an average collection period

Q83: Busing Manufacturing has a new bond issue

Q99: Within the context of working capital management,the

Q129: Hudson Valley Distributors wants to be sure

Q130: Assuming an after-tax cost of preferred stock