Use the following information and the percent-of-sales method to answer the following question(s) .

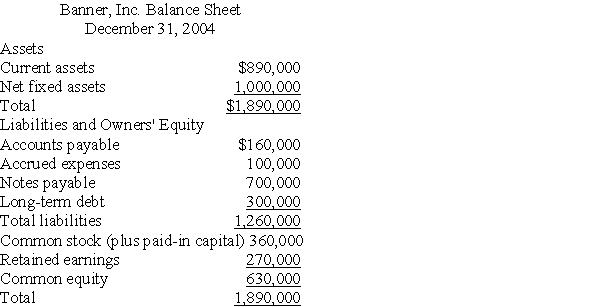

Below is the 2004 year-end balance sheet for Banner,Inc.Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005.In addition,we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales.(For consistency with the Answer selections provided,round your forecast percentages to two decimals. )

-Banner's projected accrued expenses for 2005 are:

Definitions:

Salary Allowances

Additional monetary benefits provided to employees on top of their regular salary, potentially for specific purposes or expenses.

Capital Account

An account on a country's balance of payments that records transactions involving the purchase and sale of assets, representing changes in ownership of international assets.

Partnership Agreement

A contract between partners in a business that outlines the terms of the partnership, roles, and share of profits or losses.

Profits and Losses

Profits and losses correspond to the financial gains or losses generated by a company's operations over a specific period, reflecting its economic performance.

Q3: Vipsu Corporation plans to issue 10-year bonds

Q3: How can a gold futures contract be

Q14: Which of the following terms would tend

Q19: Pledging accounts receivable as a source of

Q59: Explain why the investor's required return on

Q63: Stock splits:<br>A)increase the number of shares outstanding.<br>B)decrease

Q64: Banner's projected fixed assets for 2005 are:<br>A)$1,120,000.<br>B)$1,260,000.<br>C)$1,000,000.<br>D)$2,380,000.

Q75: Which of the following are considered to

Q76: An increase in projected _ will increase

Q114: Some complexities of conducting international business include:<br>A)multiple