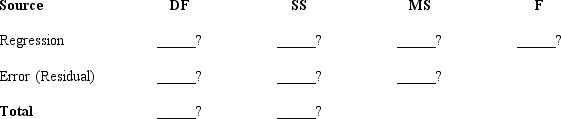

In a regression analysis involving 21 observations and 4 independent variables, the following information was obtained.  = 0.80

= 0.80

S = 5.0

Based on the above information, fill in all the blanks in the following ANOVa.Hint:  =

=  , but also

, but also  = 1-

= 1-  .

.

Definitions:

Portfolio Variance

A measure of the dispersion of the returns of a portfolio, indicating the level of risk involved.

Correlation Coefficient

A numerical indicator that shows the extent of association between two variables' movements.

Standard Deviation

A statistical measure that quantifies the dispersion or spread of a set of data points or investment returns around their mean.

Risk-Free Rate

The theoretical rate of return of an investment with no risk of financial loss, often represented by the yield on government bonds.

Q16: If the coefficient of determination is a

Q25: Refer to Exhibit 10-7. A point estimate

Q41: Refer to Exhibit 12-6. The total sum

Q65: The estimate of the multiple regression equation

Q69: An expected level of performance against which

Q75: A regression model involving 8 independent

Q88: Random samples of individuals from three

Q93: Refer to Exhibit 10-10. The test statistic

Q100: In today's market environment, you might pay

Q128: Refer to Exhibit 13-9. If you