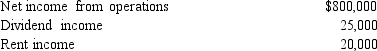

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity. Trout's taxable loss for the current year is $250,000. During the year, Catfish receives a $60,000 cash distribution from Trout. Other relevant data for Catfish are as follows:  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Biomedical Therapy

Treatments for mental disorders that involve changing brain function through chemical, surgical, or physical interventions.

Psychodynamic Therapy

A therapeutic approach emphasizing the understanding of psychological processes and conflicts as they manifest in present behavior, rooted in psychoanalytic traditions.

Transference

In psychoanalytic theory, it refers to the process where patients project feelings and attitudes from a past relationship onto the therapist.

Unconscious Feelings

Emotions and desires not immediately available to conscious awareness, often influencing behavior in unseen ways.

Q12: In what types of organizations does the

Q18: Section 1244 ordinary loss treatment is available

Q27: In a proportionate liquidating distribution in which

Q28: Liabilities affect the owner's basis differently in

Q29: The December 31, 2014, balance sheet of

Q32: The taxpayer should use ASC 740-30 (APB

Q44: A feeder organization is an exempt organization

Q69: Arthur is the sole shareholder of Purple,

Q88: The amount of a partnership's income and

Q155: In states, a(n) election permits a multinational