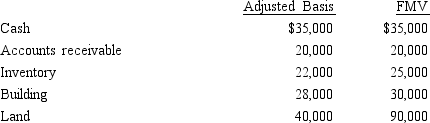

Lee owns all the stock of Vireo, Inc., a C corporation for which he has an adjusted basis of $150,000. The assets of Vireo, Inc., are as follows:

Lee sells his stock to Katrina for $300,000.

Lee sells his stock to Katrina for $300,000.

a. Determine the tax consequences to Lee.

b. Determine the tax consequences to Katrina.

c. Determine the tax consequences to Vireo, Inc.

Definitions:

Parol Evidence Rule

A legal principle that prevents parties in a written contract from presenting external evidence that contradicts or adds to the written terms of the contract.

Written Contract

An agreement between parties that is recorded in a tangible form on paper or digitally, detailing the terms and conditions bound by law.

Subsequent

Pertaining to events or actions that occur after a specified point in time.

Statute of Frauds

A legal principle requiring certain contracts, such as those for the sale of land or goods over a certain value, to be in writing and signed by the party to be charged to be enforceable.

Q32: The taxpayer should use ASC 740-30 (APB

Q42: If an individual contributes an appreciated personal

Q66: Black, Inc., is a domestic corporation with

Q68: Distribution of cash of $100,000, representing the

Q70: For a limited liability company with 100

Q71: Limited liability partnership

Q90: Randy owns a one-fourth capital and profits

Q135: When compared to a partnership, what additional

Q146: Ralph owns all the stock of Silver,

Q176: Which of the following exempt organizations are