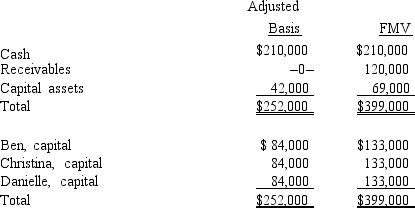

The December 31, 2014, balance sheet of the BCD LLP reads as follows.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2014, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2014, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

How much is Christina's recognized gain from the distribution and what is the character of the gain?

Definitions:

Lack Of Control Theory

A psychological concept suggesting that individuals who feel they have little control over their life circumstances are more likely to develop mental health issues.

Artifact Theory

A concept that suggests perceptions or interpretations of data can be influenced by inherent biases or flaws in the measurement process.

Hormone Theory

A concept suggesting that hormones play a central role in determining behavior and physiological processes.

Cognitive Triad Theory

A model in cognitive therapy that focuses on an individual’s negative evaluations of themselves, their world, and their future.

Q2: Sam and Vera are going to establish

Q21: Limited partnership

Q22: Which of the following entities is eligible

Q37: Consolidated group members each must use the

Q51: Book-tax differences can be explained in part

Q61: Towne, Inc., a calendar year S corporation,

Q63: Cold, Inc., reported a $100,000 total tax

Q70: Binding nature of election over multiple tax

Q74: A partnership will take a carryover basis

Q153: Which item does not appear on Schedule