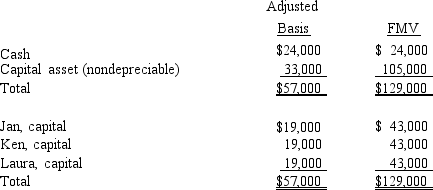

The December 31, 2014, balance sheet of the calendar-year JKL Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. On December 31, 2014, Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash. Assume the partnership makes a § 754 election for 2014.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. On December 31, 2014, Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash. Assume the partnership makes a § 754 election for 2014.

a. What is the amount of Jennifer's "stepup" adjustment under § 743(b)?

b. If the nondepreciable capital asset is sold the next year for $120,000, determine the amount of gain that Jennifer will recognize on her tax return because of the sale.

Definitions:

Unconscious Forces

Psychological factors that influence human behavior and decision-making without the individual's conscious awareness, a concept profound in psychoanalytic theory.

Libido

A term used to describe one's sexual drive or desire for sexual activity.

Sexual Frequency

A term that refers to the number of times sexual activity occurs within a specific time period.

Q21: Gold, Silver, and Bronze constitute a Federal

Q30: In the case of a complete termination

Q42: If the partnership properly makes an election

Q46: An estate may be a shareholder of

Q62: The Rub, Spill, and Ton Corporations file

Q64: Unrealized receivable

Q68: After applying the balance sheet method to

Q75: A calendar year C corporation reports a

Q112: Molly is a 30% partner in the

Q144: The § 1202 exclusion of on the