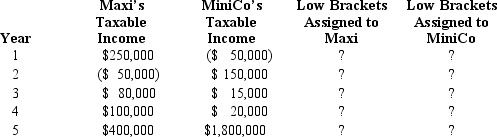

Maxi Corporation owns 100% of the stock of MiniCo, and the two corporations file a consolidated tax return. Over a five-year period, the corporations generate the following taxable income/(loss). Indicate how you would assign the taxpayers' low marginal rates that apply to the group's first $75,000 of taxable income. Explain the rationale for your recommendation.

Definitions:

Wechsler

Refers to a series of standardized tests used to assess human intelligence, developed by psychologist David Wechsler.

Emotional Intelligence

The capacity to be aware of, control, and express one's emotions, and to handle interpersonal relationships judiciously and empathetically.

Mayer

Refers to John D. Mayer, a psychologist who co-developed the theory of emotional intelligence, which emphasizes the ability to recognize, understand, manage, and use emotions effectively.

Analytical Intelligence

A facet of general intelligence that involves the ability to analyze, evaluate, judge, compare, and contrast.

Q23: The use of § 351 is not

Q68: Cooper Corporation joined the Duck consolidated Federal

Q73: A shareholder transfers a capital asset to

Q77: The Philstrom consolidated group reported the following

Q82: Racket Corporation and Laocoon Corporation create Raccoon

Q107: "Inbound" and "offshore" asset transfers by a

Q132: Hannah sells her 25% interest in the

Q132: Mars Corporation merges into Jupiter Corporation by

Q134: Your client holds foreign tax credit (FTC)

Q150: Which of the following persons typically is