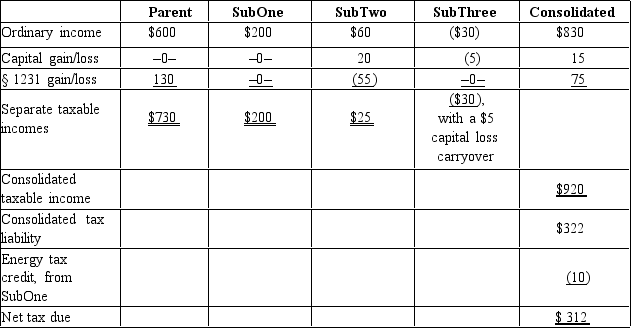

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that the members all have consented to use the relative tax liability tax-sharing method. Dollar amounts are listed in millions, and a 35% marginal income tax rate applies to all of the entities.

Definitions:

Income Statement

A report detailing a business's income, expenditures, and net earnings or losses for a given time frame.

Adjusted Trial Balance

is a list of all accounts and their balances after making adjustments, used to verify the equality of debits and credits.

Net Income

The income a company retains following the subtraction of all costs and taxes from its total revenue.

Income Statement

A financial statement that shows a company’s revenues and expenses over a specific period, ending with net income or loss.

Q40: Requires at least a 40% carryover ownership

Q44: In June of the current year, Marigold

Q59: Business reasons, and not tax incentives, constitute

Q75: A subsidiary corporation must leave the consolidated

Q80: Cash distributions received from a corporation with

Q102: Discuss the role of letter rulings in

Q103: Scarlet Corporation, the parent corporation, has a

Q105: For each of the indicated tax years,

Q108: Grebe Corporation is a car dealership that

Q147: Parent Corporation's currentyear taxable income included $100,000