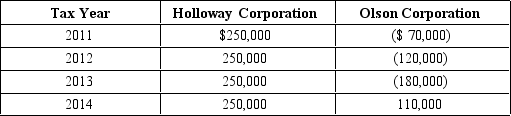

For each of the indicated tax years, compute consolidated taxable income for the calendar year Holloway Group, which elected consolidated status immediately upon creation of the two member corporations in January 2011. All recognized income related to the data processing services of the firms. No intercompany transactions were completed during the indicated years.

Definitions:

Mexican Pesos

The currency of Mexico, represented symbolically as MXN and used in financial transactions within the country.

Forward Contract

An individualized agreement allowing two parties to trade an asset at an agreed-upon price on a specified future date.

Net Income

The total profit of a company after all expenses, taxes, and costs have been subtracted from total revenue, indicating the company's financial performance over a specific period.

Discount Expense

The cost associated with the difference between the face value of a payable and the actual amount paid, recognized over the life of the debt.

Q10: The builtin loss limitation in a complete

Q19: ParentCo and SubCo have filed consolidated returns

Q41: For purposes of a partial liquidation, a

Q62: In structuring the capitalization of a corporation,

Q67: To determine current E & P, taxable

Q83: Tammy forms White Corporation in a transaction

Q89: Briefly discuss the rules related to distributions

Q114: Federal bankruptcy legislation created the reorganization. To

Q119: Aaron and Michele, equal shareholders in Cavalier

Q120: Loss on sale between related parties in