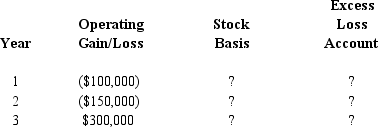

Calendar year Parent Corporation acquired all of the stock of SubCo on January 1, Year 1, for $500,000. The subsidiary's operating gains and losses are shown below. In addition, a $50,000 dividend is paid early in Year 2.

Complete the following chart, indicating the appropriate stock basis and excess loss account amounts.

Definitions:

Reptiles

Cold-blooded vertebrates characterized by scales or hard plates, such as snakes, turtles, and lizards, that reproduce mostly through eggs.

Modern-Day Mammals

Contemporary species of the mammalian class, characterized by features such as hair, three middle ear bones, and mammary glands for feeding young.

Paleontologists

Scientists who study the history of life on Earth through the examination of fossilized remains and traces of organisms.

Carbon Dating

A method used to determine the age of an object containing organic material by measuring the decay rate of carbon-14 isotopes.

Q63: A city contributes $500,000 to a corporation

Q91: Given the following information, determine if FanCo,

Q102: Blue Corporation has a deficit in accumulated

Q104: Parent Corporation, SubOne, and SubTwo have filed

Q106: Member's operating loss, when stock basis =

Q106: Asity Corporation is interested in acquiring the

Q108: The Code treats corporate distributions that are

Q112: ParentCo purchased all of the stock of

Q131: Dividends received from a domestic corporation are

Q133: Liquidating distribution