In the current year, Parent Corporation provided advertising services to its 100%-owned subsidiary, SubCo, under a contract that requires no payments to Parent until next year. Both parties use the accrual method of tax accounting and a calendar tax year. The services that Parent rendered were valued at $250,000. In addition, Parent received $20,000 of interest payments from SubCo., relative to an arm's length note between them.

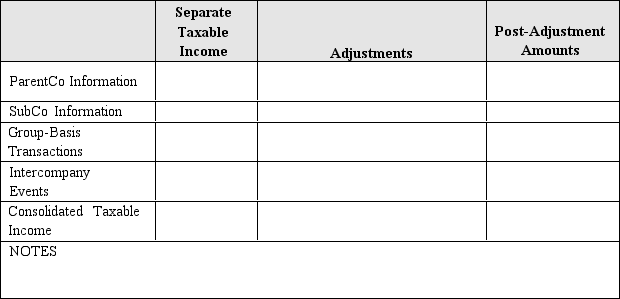

Including these transactions, Parent's taxable income for the year amounted to $400,000. SubCo reported $200,000 separate taxable income. Derive the group's consolidated taxable income, using the format of Figure 82.

Definitions:

Q4: Which of the following statements is true,

Q7: ParentCo and SubOne have filed consolidated returns

Q8: All affiliates joining in a newly formed

Q37: Olde Town, Inc., a U.S. corporation, earns

Q55: Rob and Fran form Bluebird Corporation with

Q68: Distribution of cash of $100,000, representing the

Q77: Sales price of partnership interest

Q139: Tax avoidance is not enough; transaction must

Q148: A Qualified Business Unit of a U.S.

Q155: The foreign tax credit of a consolidated