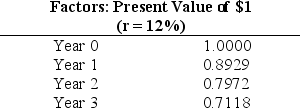

Rambus Inc.would like to purchase a production machine for $325,000.The machine is expected to have a life of three years,and a salvage value of $50,000.Annual maintenance costs will total $12,500.Annual savings are predicted to be $112,500.The company's required rate of return is 12 percent.

(1)Using the Present Value Factors for $1,calculate the net present value of this investment (ignoring taxes).

(2)Based on your answer in requirement 1,should Rambus purchase the production machine?

Definitions:

Fugitive Slave Act

Part of the Compromise of 1850, this law required that escaped slaves, upon capture, be returned to their masters and that officials and citizens of free states had to cooperate.

Kansas-Nebraska Act

A 1854 law that created the territories of Kansas and Nebraska, leaving the decision of slavery up to the popular sovereignty of those territories, effectively repealing the Missouri Compromise.

Stephen Douglas

An American politician from Illinois who was a leader of the Democratic Party and famously debated Abraham Lincoln during the 1858 Senate contest.

Transcontinental Railroad

The railway system completed in 1869 that connected the east and west coasts of the United States, greatly facilitating travel and commerce.

Q8: Refer to Exhibit 13-1.What is the debt

Q26: Victoria Company's policy is to keep 20%

Q31: Ostrich, a C corporation, has a net

Q34: Refer to Exhibit 12-3.Which of these would

Q43: All organizations must have:<br>A)a tax accountant.<br>B)a treasurer.<br>C)vice

Q48: Total costs at the low point were

Q49: All of the following appear on the

Q54: Which of the following is not a

Q57: Branford Company is bidding on a custom

Q71: During the current year, Coyote Corporation (a