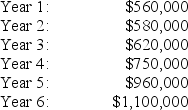

The Law Offices of Nguyen and Kline would like to open an office for six years in New Mexico.The initial investment required to purchase an office building is $2,600,000,and Nguyen and Kline needs $75,000 in working capital for the new office.Working capital will be released back to the company at the end of six years.Nguyen and Kline expects to remodel the office at the end of 4 years at a cost of $250,000.Annual net cash receipts from daily operations (cash receipts minus cash payments)are expected to be as follows:

Although the company's cost of capital is 7 percent,management set a required rate of return of 13 percent due to the high risk associated with this project.

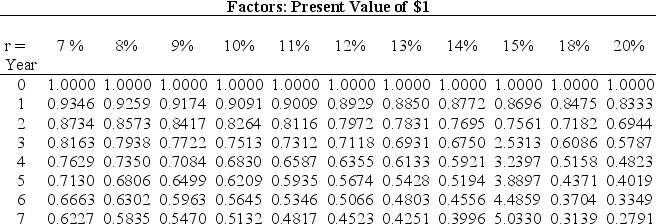

(Use the following factors for your solutions. )

(1)Calculate the net present value (NPV)of this investment.

(2)Use trial and error to approximate the internal rate of return (IRR)for this investment proposal.

(3)Based on the analyses in (1)and (2),should Nguyen and Kline open the new office? Explain.

Definitions:

Delta Waves

Delta waves are slow brainwaves, predominant in deep sleep, associated with healing and regeneration in the human brain.

Representative Sample

A subgroup of a population that accurately reflects the members of the entire population, enabling statistically valid conclusions.

Random Sample

A subset of a population selected for a study or survey in which each member has an equal chance of being chosen, ensuring the results are statistically representative of the whole.

Convenience Sample

A non-probability sampling method where the sample is taken from a group of people easy to contact or to reach.

Q21: Refer to Exhibit 12-2.Which of these items

Q29: Direct labor and direct materials are typically

Q33: In the budgeting process,the dollar amount for

Q36: All of the following are methods of

Q44: If the Manufacturing Overhead account has a

Q48: Refer to Exhibit 6-3.What is the weighted

Q52: The production budget for Ventura Company shows

Q56: Firms with significant net income always have

Q79: The contribution margin per unit is the

Q108: Schedule M-1 of Form 1120 is used