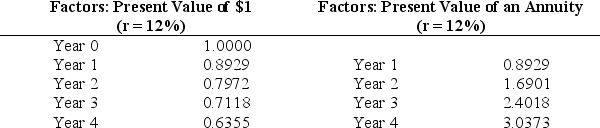

Davies Inc.would like to purchase a new machine for $300,000.The machine will have a life of four years with no salvage value,and is expected to generate annual cash revenue of $180,000.Annual cash expenses,excluding depreciation,will total $20,000.The company uses the straight-line depreciation method,has a tax rate of 30 percent,and requires a 12 percent rate of return.

(1)Find the net present value of this investment using the following factors.

(2)Should the company purchase the machine? Explain.

Definitions:

Proportional

Proportional refers to a relationship or distribution in which changes in one variable correspond to equal changes in another variable.

Social Security Tax

A tax levied on both employers and employees to fund the Social Security program, which provides retirement, disability, and survivorship benefits.

Payroll Tax

Dues collected from employees or employers, calculated by taking a fraction of the pay employers give to their workers.

Taxable Income

The amount of income that is subject to income tax after all deductions, exemptions, and adjustments have been accounted for.

Q6: Assume you receive $15,000 in four years

Q9: Refer to Exhibit 5-7.Which of the following

Q17: Refer to Exhibit 12-1.Which of these items

Q22: Cost variance analysis for activity-based costing uses

Q57: Refer to Exhibit 6-1.What is the break-even

Q60: Refer to Exhibit 10-3.Based on this information,what

Q64: Operating leverage refers to the level of

Q65: If these citations appeared after a trial

Q67: The following annual income statement is for

Q71: Refer to Exhibit 3-1.What is the overhead