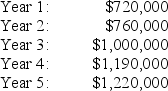

Nolan Company would like to open an office for five years in Southern California.The initial investment required to purchase an office building is $1,500,000,and Nolan needs $400,000 in working capital for the new office.Working capital will be released back to the company at the end of five years.The company expects to remodel the office at the end of 2 years at a cost of $180,000.The company only accepts projects that have a payback period of less than three years.Annual net cash receipts from daily operations (cash receipts minus cash payments)are expected to be as follows:

(1)Calculate the payback period for this project rounded to the nearest month.Show your work.

(2)Should the company accept this proposal? Explain.

Definitions:

Factory Equipment

Assets used in a manufacturing or production process, such as machinery and tools.

Factory Overhead

All indirect costs associated with manufacturing, excluding direct labor and direct materials.

Utilities Incurred

Costs accumulated from the consumption of utility services such as electricity, water, and gas.

Selling and Administrative Expense

Combined costs related to the selling of goods and the general administrative activities of a company, excluding production costs.

Q4: Operating income typically excludes items such as

Q8: In an airplane factory,which of the following

Q16: Refer to Exhibit 7-1.When the incremental revenues

Q28: Which of the following best describes the

Q45: For most nonprofit organizations,the approved budget serves

Q45: Factory maintenance costs are estimated for Bing

Q48: Total costs at the low point were

Q66: A tax bill cannot originate in the

Q74: There is one standard form of budget

Q75: The treasurer is typically in charge of