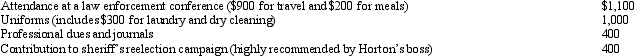

For the current year, Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Definitions:

Intercorporate Investment

Investments made by one company into another, which can include purchasing stocks, bonds, or other forms of financial interests, to exert influence or control.

Subsidiary

A company controlled by another company, the parent company, through ownership of a majority of its voting stock, offering various degrees of operational independence.

Equity Method

An accounting technique used to record investments in associated companies where the investor has significant influence, recognizing its share of profits and losses.

Reverse Takeover

A corporate strategy where a private company acquires a public company to bypass the lengthy and complex process of going public.

Q12: On January 2, 2012, Fran acquires a

Q23: The predetermined overhead rate is calculated as:<br>A)Estimated

Q46: Refer to Exhibit 3-3.Using the direct method

Q49: U.S.Generally Accepted Accounting Principles require all manufacturing

Q64: Brooke works part-time as a waitress in

Q82: Mauve Company permits employees to occasionally use

Q90: Mother participated in a qualified state tuition

Q101: Heather's interest and gains on investments for

Q111: Joe purchased a new five-year class asset

Q164: Felicia, a recent college graduate, is employed