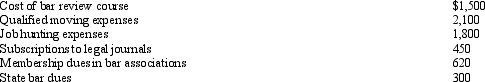

In the current year, Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Definitions:

Saving

The act of setting aside a portion of one’s income for future use, instead of spending it immediately.

Disposable Income

After subtracting income taxes, disposable income is the money remaining for individuals or households to spend or save.

MPC

The marginal propensity to consume, indicating the proportion of an additional unit of income that is spent on consumption.

MPS

Marginal Propensity to Save, which is the portion of additional income that a household saves rather than consumes.

Q2: Match the statements that relate to each

Q7: Eaton Company uses activity-based costing to allocate

Q28: Louise works in a foreign branch of

Q44: All of the following are included in

Q49: Diane purchased a factory building on November

Q58: The contribution margin income statement is used

Q69: Nicole's employer pays her $150 per month

Q85: Jake performs services for Maude. If Jake

Q115: Amy works as an auditor for a

Q137: Which of the following cannot be deducted