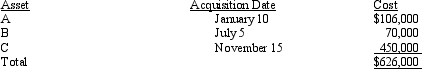

Audra acquires the following new five-year class property in 2012:

Audra elects § 179 for Asset

Audra elects § 179 for Asset

C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra takes additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Media Production

involves the creation and development of content, such as films, television shows, music, and digital media, for dissemination through various mass media platforms.

Television Audiences

The group of people who watch a particular television program or broadcast.

Realistic Evaluations

An approach in assessment that pragmatically considers the limitations, resources, and potential outcomes of a project or situation.

Working-Class Women

Women belonging to the social group characterized by jobs that require manual labor or low-skilled positions, often focusing on issues related to gender, labor, and socioeconomic status.

Q3: Which of the following assets would be

Q3: The plant union is negotiating with the

Q4: Diaz Company uses process costing in its

Q10: A debtor undergoing a Chapter 11 reorganization

Q14: The alimony rules:<br>A)Are based on the principle

Q47: Under the original issue discount (OID) rules

Q56: Distributions from a Roth IRA that are

Q58: Norm purchases a new sports utility vehicle

Q90: Aaron is a self-employed practical nurse who

Q109: Rick purchased a uranium interest for $10,000,000