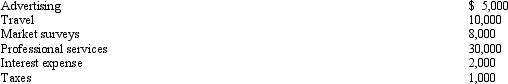

In 2012, Marci is considering starting a new business. Marci had the following costs associated with this venture:

Marci started the new business on October 1, 2012. Determine the deduction for Marci's startup costs for 2012.

Marci started the new business on October 1, 2012. Determine the deduction for Marci's startup costs for 2012.

Definitions:

Technological Change

The development and application of new technologies and methods in production, often leading to increased efficiency and productivity.

Unemployment

The situation when individuals who are capable of working and willing to work are unable to find employment.

Economic Resource

Resources utilized in creating goods and services, including land, labor, capital, and entrepreneurship.

Business Checking Account

A bank account designed for business transactions, allowing companies to easily manage their cash flow, pay bills, and deposit earnings.

Q4: Which of the following would be the

Q5: Refer to Exhibit 3-3.Using the direct method

Q28: Louise works in a foreign branch of

Q33: Ridge is the manager of a motel.As

Q38: Aiden is the city sales manager for

Q46: Audra acquires the following new five-year class

Q47: Under the original issue discount (OID) rules

Q52: Refer to Exhibit 3-3.Using the direct method

Q64: The term "product costs" refers exclusively to

Q112: Qualifying job search expenses are deductible even