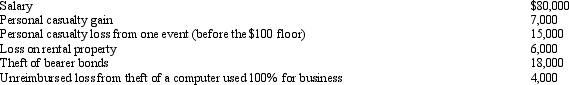

Gary, who is an employee of Red Corporation, has the following items for 2012:

Determine Gary's AGI and total amount of itemized deductions for 2012.

Determine Gary's AGI and total amount of itemized deductions for 2012.

Definitions:

Unallocated Positive

A term that is not widely recognized as standard in accounting or finance; it may refer to surplus income or assets not yet designated for a specific purpose but NO.

Goodwill

An intangible asset that arises when a buyer acquires an existing business, representing the value of the business's reputation, brand, and other unidentifiable assets.

Significant Influence

The power to participate in the financial and operating policy decisions of an investee, but not control them, typically associated with ownership of 20%-50% of voting stock.

IAS 28

An International Accounting Standard that prescribes the accounting for investments in associates and sets the requirements for the application of the equity method when accounting for investments in associates and joint ventures.

Q6: On July 20, 2010, Matt (who files

Q6: Dave is the regional manager for a

Q7: Nonmanufacturing costs include direct labor and indirect

Q14: Theron Industries has the following financial data

Q20: Managerial accounting focuses on providing historical financial

Q21: Match the statements that relate to each

Q25: Blue Corporation incurred the following expenses in

Q38: Norma's income for 2012 is $27,000 from

Q57: For a custom home builder,lumber should be

Q80: George, an unmarried cash basis taxpayer, received