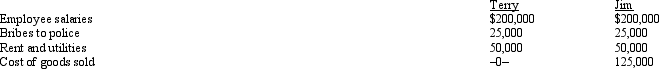

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Defined Area

A specifically designated or identified geographical location, characterized by particular attributes or boundaries.

Consumer Products

Goods bought and used by individuals and households for personal consumption.

Pay-Per-View

A service through which television viewers can purchase events to be viewed on their home TVs.

Amazon Prime Video

A subscription video-on-demand service offered by Amazon, providing access to a wide range of films and television series.

Q17: Jim had a car accident in 2012

Q18: Keith, age 17 and single, earns $3,000

Q28: One indicia of independent contractor (rather than

Q43: In contrasting the reporting procedures of employees

Q50: The domestic production activities deduction (DPAD) for

Q63: Early in the year, Marion was in

Q139: Ramon and Ingrid work in the field

Q144: For self-employed taxpayers, travel expenses are not

Q148: The stock of Eagle, Inc.is owned as

Q164: Felicia, a recent college graduate, is employed