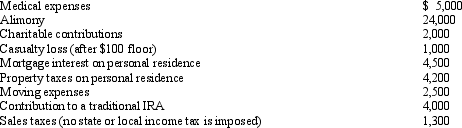

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Definitions:

Goodwill

An intangible asset that arises when a company is purchased for more than the value of its net tangible assets, often related to reputation or brand.

Fair Value

An estimate of the market value of an asset or liability, based on current prices in an orderly transaction between market participants at the measurement date.

Pre-Acquisition Subsidiary Revenues

Revenues generated by a subsidiary prior to being acquired by a parent company.

Q4: On February 20, 2011, Bill purchased stock

Q16: Bonnie purchased a new business asset (five-year

Q25: The amount of Social Security benefits received

Q25: Jim acquires a new seven-year class asset

Q29: Emily is in the 35% marginal tax

Q52: Neal, single and age 37, has the

Q75: If more than 40% of the value

Q89: In 2012, Morley, a single taxpayer, had

Q91: Wilma, age 70 and single, is claimed

Q128: An "above the line" deduction refers to