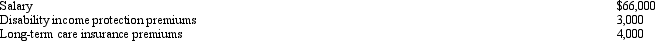

James, a cash basis taxpayer, received the following compensation and fringe benefits in 2012:  His actual salary was $72,000. He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed. The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000. He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed. The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

Definitions:

Physical Activities

Any bodily movement produced by skeletal muscles that requires energy expenditure, including exercises and daily routine movements.

Telephone Responses

Answers or feedback collected over the phone, often used in surveys or customer service inquiries.

Applicants

Individuals who apply or make a formal request for something, typically a job or admission to an educational institution.

Ethnicity

A category of people who identify with each other based on common ancestral, social, cultural, or national experiences.

Q1: Bill is employed as an auditor by

Q25: Ed is divorced and maintains a home

Q28: The alimony recapture rules are intended to:<br>A)Assist

Q30: A business bad debt is a debt

Q39: With respect to income from services, which

Q49: James is in the business of debt

Q53: "First-tier distributions" allowed by the will or

Q59: The tax professional can do more than

Q67: Trade and business expenses should be treated

Q120: Elsie lives and works in Detroit.She is