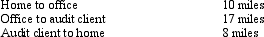

Bill is employed as an auditor by a CPA firm.On most days, he commutes by auto from his home to the office.During one month, however, he has an extensive audit assignment closer to home.For this engagement, Bill drives directly from home to the client's premises and back. Mileage information is summarized below:

If Bill spends 21 days on the audit, what is his deductible mileage?

If Bill spends 21 days on the audit, what is his deductible mileage?

Definitions:

Classes

Categories or groups into which data can be divided based on certain characteristics or attributes.

Relative Frequencies

The measures showing the number of times a certain event occurs in relation to the total number of events, often expressed as a percentage or fraction.

Sample Size

The number of observations or entities included in a sample, which represents a portion of the total population.

Cumulative Frequency

The running total of frequencies up to a certain point in a set of data.

Q16: Landscaping expenditures on new rental property are

Q20: Managerial accounting focuses on providing historical financial

Q22: Faith just graduated from college and she

Q27: Green, Inc., manufactures and sells widgets. During

Q28: One indicia of independent contractor (rather than

Q29: Emily is in the 35% marginal tax

Q57: Iris collected $100,000 on her deceased husband's

Q66: The president of Silver Corporation is assigned

Q115: A cash basis taxpayer took an itemized

Q154: Logan, Caden, and Olivia are three unrelated