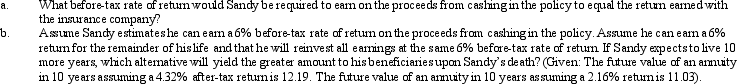

Sandy is married, files a joint return, and expects to be in the 28% marginal tax bracket for the foreseeable future.All of his income is from salary and all of it is used to maintain the household.He has a paid-up life insurance policy with a cash surrender value of $100,000.He paid $60,000 of premiums on the policy.His gain from cashing in the life insurance policy would be ordinary income.If he retains the policy, the insurance company will pay him $3,000 (3%) interest each year.Sandy thinks he can earn a higher return if he cashes in the policy and invests the proceeds.

Definitions:

Freedmen's Bureau

A post-Civil War agency established by the U.S. government in 1865 to assist freed slaves in the South with education, health care, employment, and legal support.

Black Education

The historical movement and ongoing efforts to ensure educational access, quality, and equity for African American or Black populations, particularly in the context of segregation and discrimination.

Northern Societies

Refers to communities or groups located in the northern part of a country or continent, often characterized by specific cultural, economic, and social traits distinct from those in southern regions.

Cotton Prices

The cost or monetary value of cotton on the global or local market, influenced by factors like supply, demand, and global economic conditions.

Q4: In the current year, Bo accepted employment

Q9: When a trust distributes an in-kind asset

Q51: A complex trust automatically is exempt from

Q71: Lola, a calendar year taxpayer subject to

Q77: Employees of the Valley Country Club are

Q98: On June 1, 2012, Sam purchased new

Q100: In terms of income tax consequences, abandoned

Q101: In 2004, Terry purchased land for $150,000.

Q122: Under what circumstances, if any, may an

Q149: For the current football season, Tern Corporation