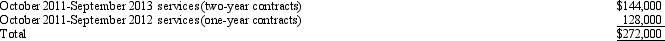

Orange Cable TV Company, an accrual basis taxpayer, allows its customers to pay by the year in advance ($500 per year) , or two years in advance ($950) .In September 2011, the company collected the following amounts applicable to future services:  As a result of the above, Orange Cable should report as gross income:

As a result of the above, Orange Cable should report as gross income:

Definitions:

1-Bromopentane

An organobromine compound consisting of a five-carbon alkane with a bromine atom attached to the primary carbon.

Di-sec-Butyl Ether

An organic compound formed by the dehydration reaction between two sec-butyl alcohol molecules, resulting in an ether with a dialkyl structure.

Sec-Butanol

A secondary alcohol with the chemical formula C4H10O, where the hydroxyl group is connected to the second carbon in a butane chain.

Sulfuric Acid

A highly corrosive strong mineral acid with the molecular formula H2SO4, widely used in industry for processes including fertilizer manufacturing, oil refining, and wastewater processing.

Q1: If a vacation home is classified as

Q7: The Suarez Trust generated distributable net income

Q15: Discuss the beneficial tax consequences of an

Q37: A business bad debt can offset an

Q64: Brooke works part-time as a waitress in

Q70: Certain individuals are more likely than others

Q78: Even if the individual does not spend

Q84: A single trust that is operated independently

Q90: Mother participated in a qualified state tuition

Q145: A hobby activity can result in all