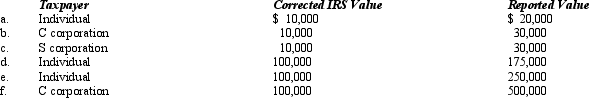

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case, assume a marginal income tax rate of 35%.

Definitions:

Extinct Organisms

Species that no longer exist, having disappeared from their natural habitats and are no longer part of Earth's biodiversity.

Fossil Record

The history of life on Earth as represented by fossils, the preserved remains or traces of organisms.

Behavior

The actions or reactions of an organism, often in response to its environment, which can be innate or learned.

Turtles

Reptiles with a bony or cartilaginous shell developed from their ribs that acts as a shield.

Q17: During the year, Kim sold the following

Q24: A Form 1041 must be filed by

Q36: A _ trust is a revocable entity

Q68: Jilt, a non-U.S.corporation, not resident in a

Q79: In 2012, Warren sold his personal use

Q84: The following income of a foreign corporation

Q99: Bulky Company sold an asset on the

Q121: A per-day, per-share allocation of flow-through S

Q125: Britta, Inc., a U.S.corporation, reports foreign-source income

Q150: An increase in a taxpayer's AGI will