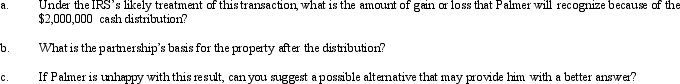

Palmer contributes property with a fair market value of $4,000,000 and an adjusted basis of $3,000,000 to AP Partnership.Palmer shares in $1,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $4,000,000.One month after the contribution, Palmer receives a cash distribution from the partnership of $2,000,000.Palmer would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Palmer's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Leading Indicator

Economic factors that change before the economy starts to follow a particular pattern or trend, used to predict future economic activity.

Corporate Social Responsibility Objective

A self-regulated business model that helps a company be socially accountable—to itself, its stakeholders, and the public.

Capital Investment

Funds spent by a company to acquire or upgrade physical assets such as property, industrial buildings, or equipment.

Land Reclamation

The process of creating new land from oceans, riverbeds, or lake beds, or restoring an area to a more usable state.

Q12: Arbor, Inc., an exempt organization, leases land,

Q17: Dott Corporation generated $300,000 of state taxable

Q29: An S corporation's separately stated items are

Q33: Wade and Paul form Swan Corporation with

Q43: Under certain circumstances, a distribution can generate

Q45: Carl transfers land to Cardinal Corporation for

Q62: A subsidiary corporation is liquidated at a

Q96: On January 2, 2011, Tim loans his

Q97: Martha receives a proportionate nonliquidating distribution when

Q105: Loss will be recognized on any distribution