Dott Corporation generated $300,000 of state taxable income from selling its mapping software in States A and

B.Both states utilize a three-factor apportionment formula which equally weights sales, property, and payroll.The rates of corporate income tax imposed in A and B are 7% and 10%, respectively.Determine Dott's state income tax liability.

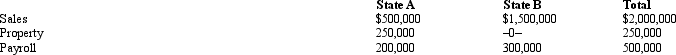

B.For the taxable year, the corporation's activities within the two states were as follows.

Dott has determined that it is subject to tax in both A and

Dott has determined that it is subject to tax in both A and

Definitions:

Credibility

The quality of being trusted and believed in, often based on a reputation for honesty and reliability.

Potential Customers

Individuals or entities that are considered likely candidates to purchase a company's products or services but have not yet done so.

Business Communications

The exchange of data among individuals both inside and outside a company in a formal environment.

"You" Attitude

A way of communicating that focuses on the listener or reader, emphasizing their needs and interests.

Q1: Estela, Inc., a calendar year S corporation,

Q12: Compute the undervaluation penalty for each of

Q35: OutCo, a controlled foreign corporation owned 100%

Q36: After the completion of an audit, the

Q49: Miracle, Inc., is a § 501(c)(3) organization

Q89: Soft, Inc., a § 501(c)(3) organization, has

Q110: An entity satisfies the "not-for-profit" requirement for

Q121: In computing Federal taxable income, can the

Q131: Waltz, Inc., a U.S.taxpayer, pays foreign taxes

Q145: When a beneficiary receives a distribution from