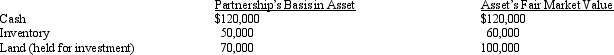

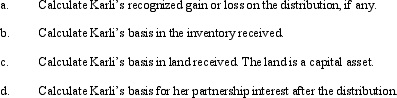

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date, she receives a proportionate nonliquidating distribution of the following assets:

Definitions:

Maslow

A psychologist known for proposing the hierarchy of needs theory, suggesting that people are motivated to fulfill basic needs before moving on to higher levels of need.

Satisfier Factors

Are found in job content, such as a sense of achievement, recognition, responsibility, advancement and personal growth.

Two-Factor Theory

A psychological theory by Frederick Herzberg stating that job satisfaction and dissatisfaction are influenced by two independent sets of factors: motivators and hygiene factors.

Job Satisfaction

The level of contentment employees feel about their work, which can influence their performance and retention.

Q23: To make a valid S election, the

Q38: A feeder organization is exempt from Federal

Q48: Tanya is in the 35% tax bracket.

Q69: Korat Corporation and Snow Corporation enter into

Q71: Discuss benefits for which an exempt organization

Q76: Mercy Corporation, headquartered in F, sells wireless

Q78: No dividends received deduction is allowed unless

Q127: An S corporation does not recognize a

Q131: Tyler's basis in his partnership interest is

Q157: Grams, Inc., a calendar year S corporation,