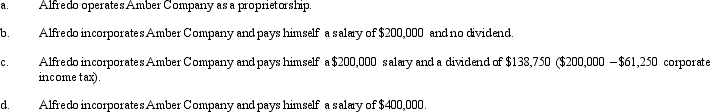

Amber Company has $400,000 in net income in 2012 before deducting any compensation or other payment to its sole owner, Alfredo. Assume that Alfredo is in the 35% marginal tax bracket. Discuss the tax aspects of each of the following independent arrangements. (Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Definitions:

Adjustment

The process of adapting or becoming accustomed to new conditions or environments.

External Locus

A belief that one’s outcomes or circumstances are determined by external factors, events, or influences, as opposed to one's own effort or actions.

Self-esteem

A person's personal assessment of their own merit or importance.

Social Empathy

The ability to understand and relate to the experiences, thoughts, and emotions of individuals from different backgrounds and cultures.

Q5: What is a deathbed gift and what

Q6: Cason is filing as single and has

Q15: Jake, the sole shareholder of Peach Corporation,

Q16: Because services are not considered property under

Q27: All of a C corporation's AMT is

Q37: During the current year, Goldfinch Corporation purchased

Q42: Can AMT adjustments and preferences be both

Q67: In 2012, Father sold land to Son

Q68: Canary Corporation, an accrual method C corporation,

Q117: Kite Corporation has 1,000 shares of stock