Essay

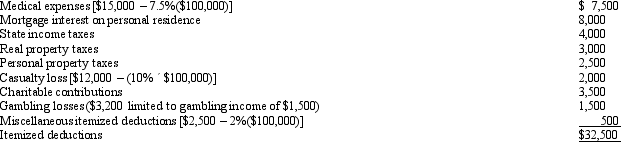

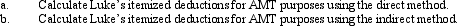

Luke's itemized deductions in calculating taxable income are as follows:

Definitions:

Related Questions

Q10: How does the replacement time period differ

Q37: Andrea, who is single, has a personal

Q55: Alex used the § 121 exclusion three

Q61: In a § 351 transaction, Gerald transfers

Q64: What are the tax consequences of a

Q91: In 2005, Donna transferred assets (basis of

Q93: A business taxpayer sells inventory for $40,000.The

Q97: Heron Corporation, a calendar year C corporation,

Q110: Capital recoveries include:<br>A)The cost of capital improvements.<br>B)Ordinary

Q136: As of January 1, Cassowary Corporation has