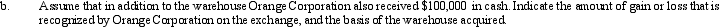

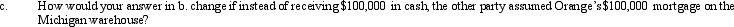

a. Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000) for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange, and the basis of the warehouse acquired.

Definitions:

Coping Strategy

A method or approach employed by an individual to handle stress, adversity, or problems in an effective way.

Distress

Negative stress experienced as a result of challenging situations, often leading to discomfort or emotional pain.

DSM-5

The fifth edition of the Diagnostic and Statistical Manual of Mental Disorders, a comprehensive classification of mental health conditions and criteria for diagnosis.

Self-Indulgence

Engaging in one's desires and impulses excessively, often at the expense of others or one's own wellbeing.

Q12: A C corporation is required to annualize

Q22: Which of the following statements concerning the

Q37: In a nontaxable exchange, the replacement property

Q56: Sand Corporation, a calendar year taxpayer, has

Q66: Carl sells his principal residence, which has

Q73: Individuals with modified AGI of $100,000 can

Q76: Vic's at-risk amount in a passive activity

Q81: C corporations are subject to a positive

Q95: During the year, Purple Corporation (a U.S.Corporation)

Q106: Seamus had $16,000 of net short-term capital