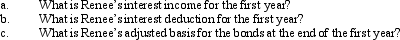

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

Individualism

A theory advocating for individual autonomy and choice over the constraints imposed by group or governmental authority.

Market Revolution

A dramatic increase in the exchange of goods and services in market transactions, marked the transformation of the American economy from predominantly agrarian to a more industrial and commercial system in the 19th century.

Sovereign Individuals

Individuals who believe they have the ultimate authority over themselves and their property, often advocating for minimal or no governmental control or interference.

Q19: Nancy and Tonya exchanged assets.Nancy gave Tonya

Q21: Maria, who owns a 50% interest in

Q35: Kenton has investments in two passive activities.Activity

Q38: Luke's itemized deductions in calculating taxable income

Q57: The child tax credit is based on

Q67: In the current year, Kelly had a

Q72: If a taxpayer purchases taxable bonds at

Q87: If a taxpayer reinvests the net proceeds

Q106: Seamus had $16,000 of net short-term capital

Q159: Since wash sales do not apply to