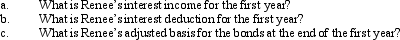

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

Action Potentials

Rapid and temporary electrical impulses that travel across the membrane of a neuron, allowing for communication between neurons.

Awareness

The knowledge or perception of a situation or fact.

Sleep Disorder

A condition that frequently impacts a person's ability to get enough quality sleep, often leading to functional impairment throughout the day.

REM Rebound

Increased amounts of REM sleep after being deprived of REM sleep on earlier nights.

Q2: Schedule M-1 of Form 1120 is used

Q3: Which of the following itemized deductions definitely

Q6: Some (or all) of the tax credit

Q15: Pink Corporation is an accrual basis taxpayer

Q28: A calendar year C corporation can receive

Q38: During the current year, Shrike Company had

Q51: Camelia Company is a large commercial real

Q84: Roxanne, who is single, has $125,000 of

Q89: The tax credit for rehabilitation expenditures for

Q125: When an individual taxpayer has a net