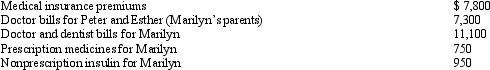

Marilyn is employed as an architect.For calendar year 2012, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Definitions:

Q1: Joyce, a farmer, has the following events

Q16: Donald owns a principal residence in Chicago,

Q16: In contrast to a fact or lay

Q24: Marilyn is employed as an architect.For calendar

Q33: Which of the following is a fictitious

Q55: If an employee holds two jobs during

Q66: The states that impose a general sales

Q112: Ross lives in a house he received

Q139: What are the pros and cons of

Q139: Shari exchanges an office building in New